GST For India

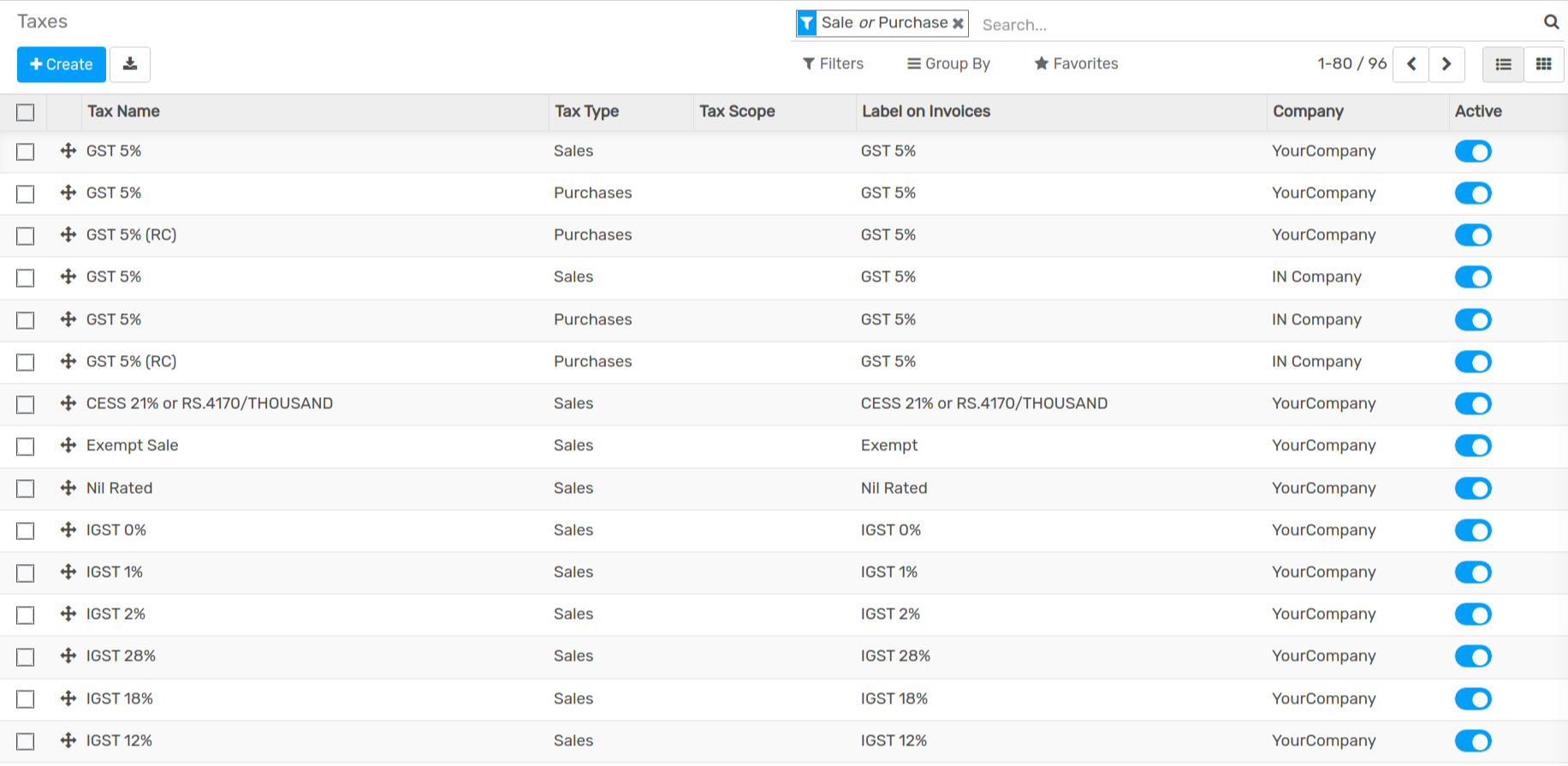

Pre defined well structured system

Flectra ERP comes with well structure accounts and tax templates, making it easy for businesses to get started, no accounting or tax related setup required. Just add your GSTIN number and you are all set to use the system.

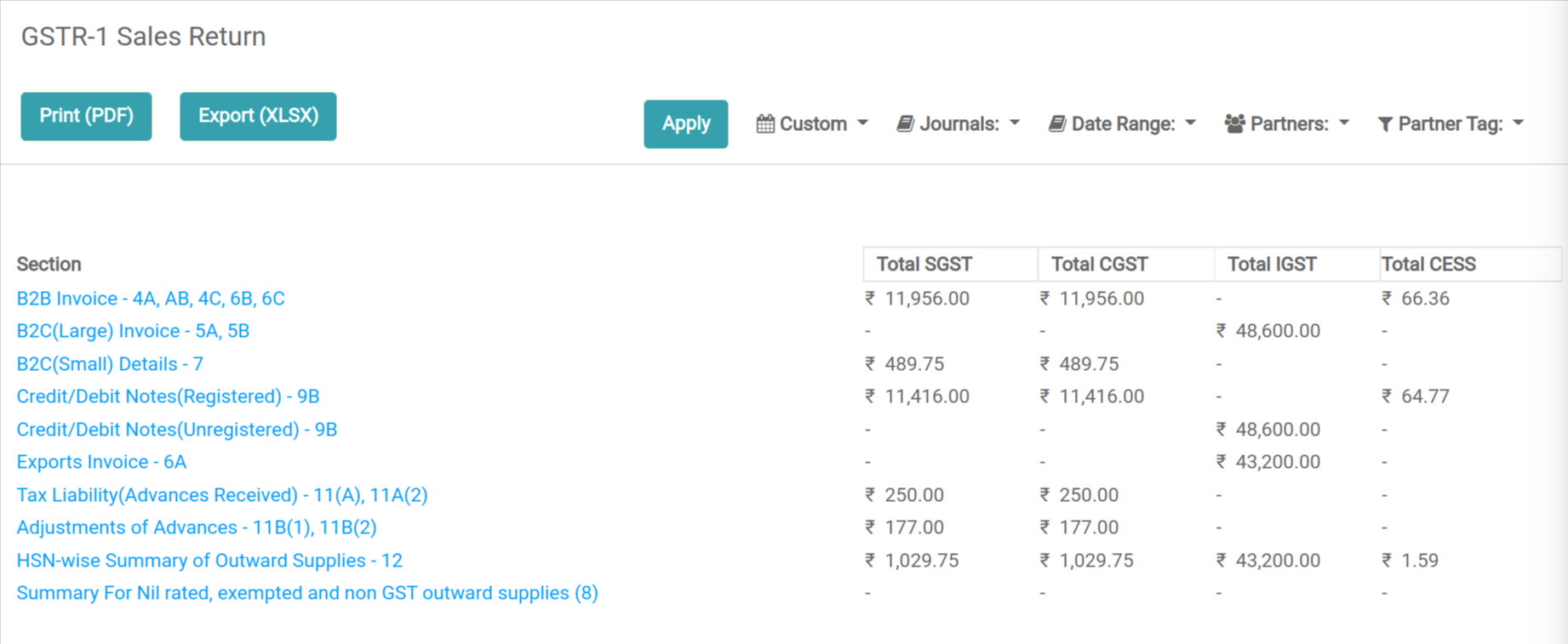

GSTR-1

Easily generate tax return for outward supplies for business to business (B2B), Business to Consumer (B2C) transactions including Large Business To Consumer (B2CL) transaction. Track reverse charges along with ready to upload product HSN report.

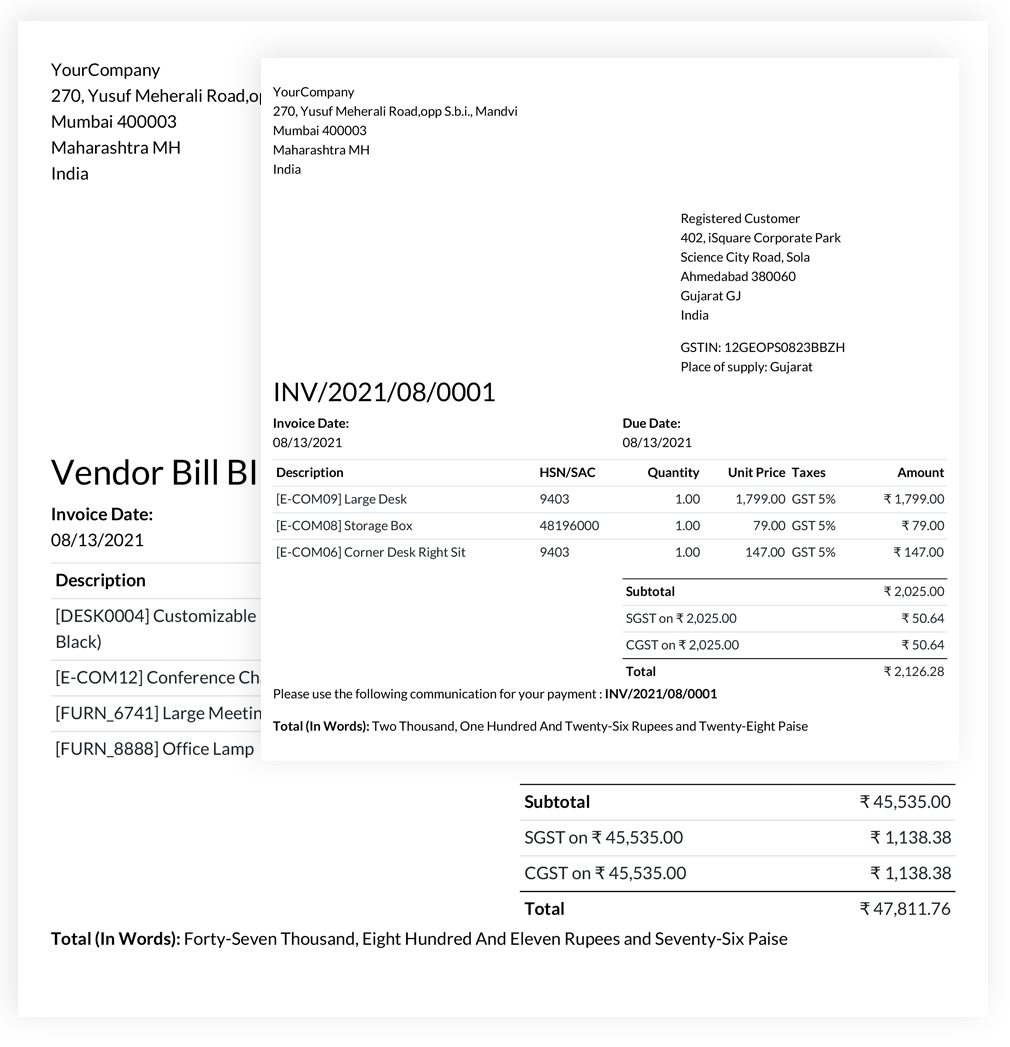

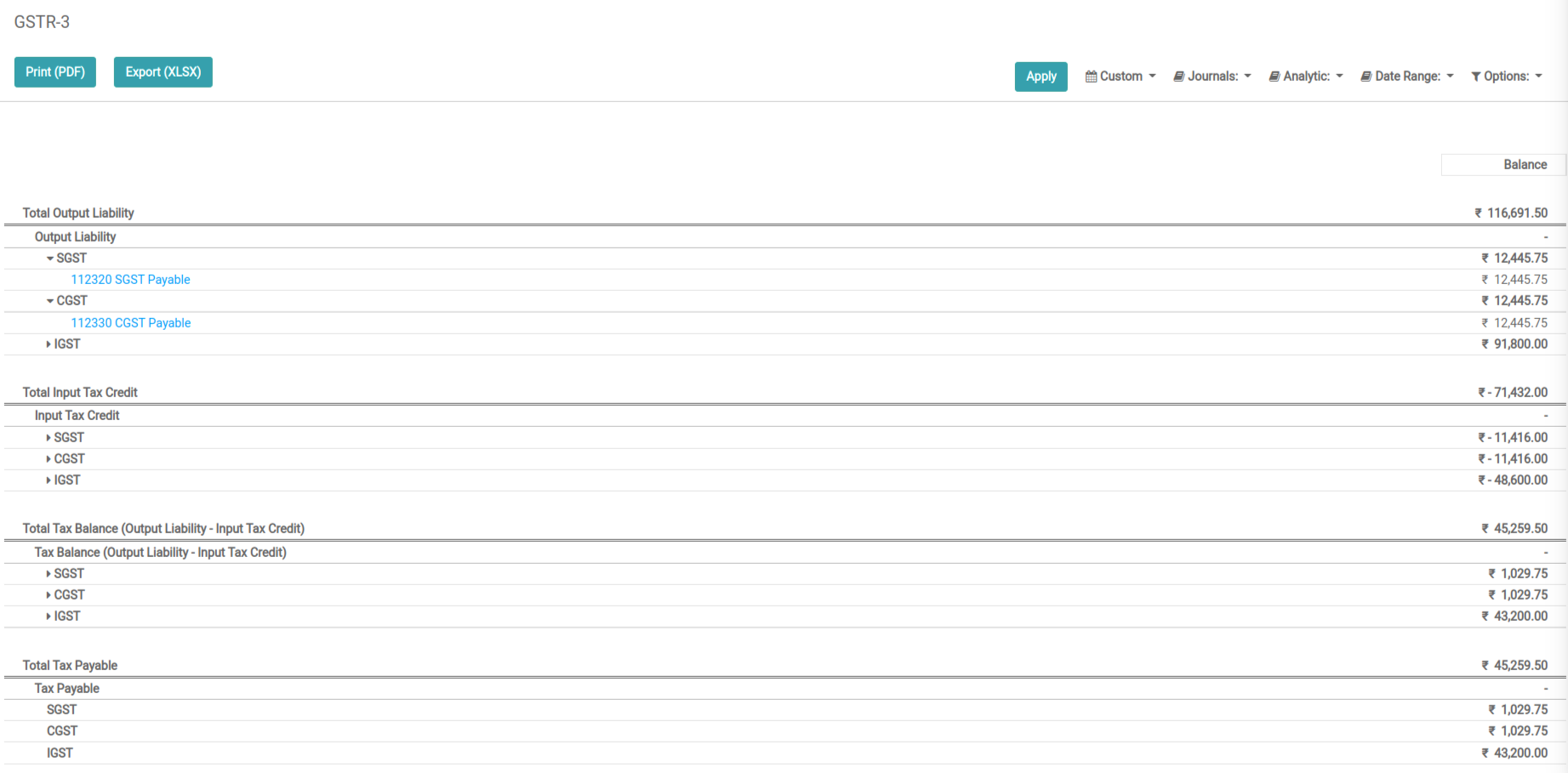

GSTR-3

Report your purchases easily from registered supplier from your invoices for quicker buyer seller reconciliation process.

...Including Incredible Features

- Accounts Receivable

- Bank Reconciliation

- Billing & Invoicing

- Expense Tracking

- Fixed Asset Management

- Tax Management

- Proforma Invoices

- Multiple Taxes per Line

- Multi-Step Payments Terms

- Automated Follow-up Letters

- Automated Follow-up Actions

- Automated Recurring Invoices

- Multiple Journals

- Profit & Loss

- Balance Sheet

- Cashflow statement

- General Ledger

- Tax Reports

- Customizable Reports

- Customizable Dashboards

- Configurable Email Templates

- Multi-Currency

- Multi-Company Consolidation

- Multi-User